As one of the world’s largest market research companies, GfK offers valuable insight into the way people live, think and shop. Client insight manager Marco Salerno looks back on the past year as the UK prepares to come out of lockdown.

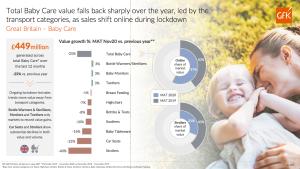

“As reports of sharp declines in consumer spending emerge it’s clear that the baby care market has been hit hard throughout 2020. Overall value across the baby care markets fell by 25% over the 12 months to November, equating to a massive £149m, with volume also down 16%. Although some online retailers will have benefited from lockdown shopping habits, it’s clear that trading conditions are still very tough for high-street retailers coming into 2021. Nevertheless, there are reasons for optimism looking ahead towards the later year.

Over the last 12 months, the value share of online sales compared to in-store has risen from 40% to 57% – and is as high as 86% in baby monitors and 83% in highchairs. Lower-priced categories, which are typically more reliant on in-store impulse purchasing, have also seen a change, with more than 20% of soothers sold (by value) have been generated through online sales – up from 11% last year. Periods of lockdown and store closures have driven these trends and while we can expect a reversal, many consumers will continue making their purchases online even once stores reopen.

At a category level the transport markets have the most dramatic impact on these topline declines. A 40% year-on-year value fall in strollers and 25% fall in car seats indicates that consumers are not replacing or upgrading their models to the same extent, with first-time buyers more likely to rely on second-hand models. This fall in demand is entirely expected, with many facing financial hardship, alongside the restrictions placed on travelling outside the local area.

On a more positive note, there are certain baby care sectors which are bucking the trend and achieving ongoing value gains. Bottle warmers and sterilisers lead the way, alongside teethers and baby monitors. The 3% value gain in baby monitors (worth £680,000) is especially notable, given the yearly declines seen from 2016 through to 2019.

Although growth in these areas was concentrated more heavily towards the early year and first lockdown period, they do give hope for various brands and retailers coming into 2021. The need for brands and retailers to capitalise on the demand, both through their in-store and online offerings, will be crucial in shaping the future industry landscape.”

See the original article in full here, in the most recent issue of Progressive Preschool magazine.