Consumers have already started to change their toy buying habits as they react to the cost of living squeeze, according to The NPD Group.

Feeling the greatest impact are toys at the lowest and highest ends of the price scale, as shoppers cut back ahead of the toy market’s most important sales season of the year.

Shoppers’ budgeting has hit sales of less expensive toys the most. In the past, two thirds of the toys sold (70%) in the first three quarters of any year have been priced under £10. However this year, this price point has experienced some of the largest declines vs. the same period in 2021 (January to September), falling -15%, a value loss of £62.3 million.

Historically, toys costing £10 or less account for one quarter of all toys bought in the last three months of the year. If the budgeting trend in this segment of the market continues into November and December, these lower-priced toys, often used as stocking fillers, could be at risk this Christmas.

Sales of big-ticket toys priced £50+ decline -8%

At the other end of the spectrum, toys sold for £50 and over declined -8%, a loss of £13 million. With Christmas approaching, the NPD Group usually reports an increase in the big-ticket items for the final months of the year, and so far in 2022, this trend has yet to emerge.

With Christmas Eve falling on a Saturday, consumers may wait to shop for toys at the very last minute. We last saw this trend in 2016 when the final week prior to Christmas saw massive sales increases and was the largest shopping week of the year for the sector.

With rising inflation impacting all homes in Britain, we might have expected sales of the cheapest toys to rise. However, consumers aren’t necessarily trading down to the lowest-priced toys and have cut non-essential toy purchases, while the toys in the mid-priced tiers are seeing an uplift.

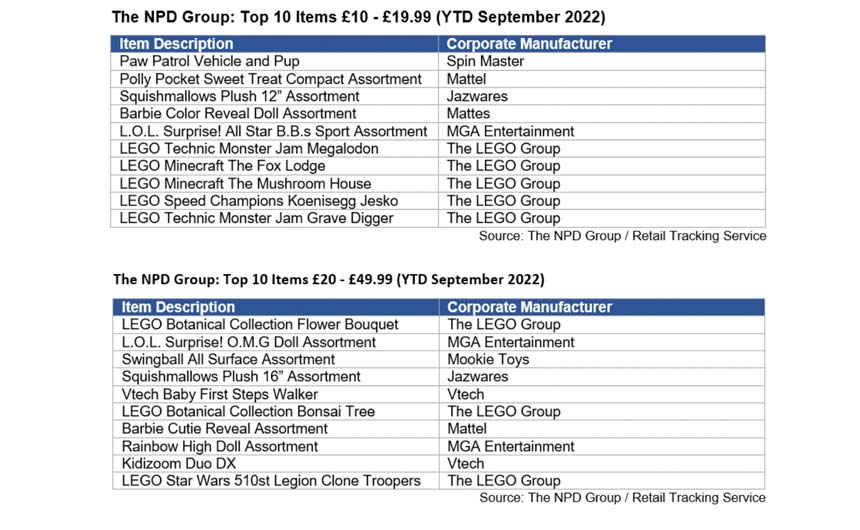

Sales of toys priced from £10 to £19.99 are up +1% and those with price tags from £20 to £49.99 are up +7% as some consumers may be purchasing multiple mid-priced toys rather than one big one. Categories that have performed well are the ones that appeal to all ages and genders: Traditional Plush, Action Figures, Preschool Figures & Play-sets and Action Figure Collectables.

“With money tight for so many, consumers have been cutting back on buying toys at the lowest and highest ends of the price scale,” commented Melissa Symonds, executive director, UK toys at NPD. “Now we are in the run-up to Christmas, we would expect sales to increase and it will be fascinating to see at what price point. In recent years, supply has been a major issue with many parents struggling to find the toys on their child’s wish list.

“Today, the challenge is one of affordability and canny consumers will be looking for discounts and promotions like Black Friday to help make their Christmas budgets go further. With Christmas Eve falling on a Saturday, we predict that sales will be made right up to 24 December as shoppers wait in hope of grabbing a last minute bargain.”